Next events

See all eventsNews

AluQuébec welcomes three new co-opted directors

The industry

The aluminium sector is an industry of strategic significance for the province of Québec and has a major economical impact.

Thanks to an annual production of 2.9 million tons of aluminium and with one of the lowest carbon footprints in the world, Québec is a top-tier worldwide exporter. Of the total 38,000 jobs in Québec’s aluminium industry, 80% (29,800) are allocated in the 1,734 processing companies. The turnover attributable to aluminium processing amounts to $11.6B.

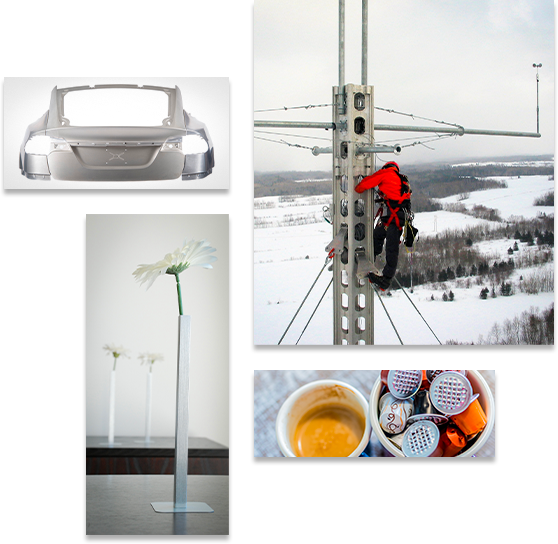

Benefiting from a multisectoral economy (transport, construction, infrastructure, aerospace, packaging, etc.), Québec’s aluminium industry is made up of international caliber companies as well as an important network of research and development in aluminium, thanks to seven state-of-the-art research centres and companies where innovation is a common value.

Directories

Footbridges designed and/or fabricated in Québec

Consult our directory of footbridges conceived and fabricated in Québec, the oldest one celebrating its 35th anniversary in 2021… without any maintenance!

Aluminium innovation in buildings

The innovation directory offers you a tour around the world to discover multiple innovative applications and uses of aluminium in infrastructures.

Aluminium distributors in Québec

Whether you need a type 5052 H32 aluminium alloy plate or a type 1100 rod, consult our directory to find aluminium products quickly and easily.

Aluminum's Ecosystem

Primary

The eight smelters in Québec cumulate an annual production of 2.9 million tons of first fusion aluminium with the lowest carbon footprint in the world.

Processing

Québec’s aluminium industry has more than 1734 companies of first, second and third processing allocated around the province.

Equipment suppliers

Québec’s equipment and specialized suppliers distinguish themselves with high technology equipment and by providing on-demand solutions to smelters around the world.

Recyclers

Close to 50 companies recycle and revalue aluminium scrap originating from smelters and processing companies.

Research centres

The presence of seven public and private research centres in Québec allows aluminium users to access scientific expertise to develop innovative and performing solutions.

Toolbox

Information

The CeiAl is your source of information for any question or technical demand relating to aluminium use.

- Standards

- Alloys

- Surface treatments

- Outreach, technical and scientific articles

Training

The CeiAl is an ally to perfect your technical knowledge on aluminium.

- Webinars

- Conferences

- Courses

Design and technical support

The CeiAl is your partner in concept development and product designing.

- Computer-aided design (CAD)

- Finite Element Analysis (FEA)

- Assembly technique

- Range shaping design

- Manufacturing feasibility analysis